Octopus Strategy: An Innovative Way of Distributing Dive Gear & Scuba Training to Today’s Consumers

How can the scuba diving industry best meet today’s consumers’ expectations?

A local dive shop sells six lines of products & services to divers. Providing scuba diving training and selling dive gear are the two most significant sources of revenue. We’ll look at how dive centers currently promote and deliver these products and services to divers. Then, we’ll propose a new structure to do it with the Octopus Strategy.

Let’s put aside, for now, what we like, what we prefer, what is easier for us, what is most profitable for us — or what dive training agencies and scuba gear manufacturers want us to do. Instead, let’s look at what the consumer wants when shopping for scuba diving training and dive equipment.

It’s a broad question. We could draft a long list of what consumers want, including safety, fun, entertainment, convenience, a reasonable price, prestige, fish watching, challenges, etc. But for now, we will focus on what we believe are serious structural flaws in our current scuba industry product distribution channels — flaws that could be fixed with the Octopus Strategy.

This post is part of our Shifting Tides: Dive Industry Assessment & Strategies for Today’s Scuba Divers series by the Business of Diving Institute and Darcy Kieran, author of:

Table of Contents

First Part of Our Scuba Diving Industry Octopus Strategy: Dive Training

When somebody decides to go scuba diving, he/she soon realize that he/she need a “card” that he/she will get after a course. Now what?

Where do consumers look for dive training?

Usually, clients who have never gone scuba diving, assume that all dive schools are safe, and a Training Agency X course is the same at all dive centers X. Of course, we know it’s not the case as we’ve discussed in the lack of consistency in the quality of the experience.

For now, let’s imagine these possible future clients looking for a scuba diving entry-level course. Where do they go? Usually, they go online, and they search for a place “near where they are.”

We say “near where they are” because it’s not necessarily near where they live. It may be near the hotel they are staying at in Bonaire — and often, inside the hotel. Of course, if you’re in Key West, all dive shops are near your hotel!

If they are looking at taking such a course in their hometown, it may be near where they live. It may also be near where they work, if they want to take a scuba class after a day at the office, on weekdays.

How often do you see a scuba diver, in an origin location (an urban area like Chicago, Nashville, or Montreal) come to your dive shop from far away? It’s pretty rare. Usually, your student-divers come from a limited driving distance to your dive shop. That’s why DEMA offers a service to determine the socio-demographic profile of people living within a 15-minute (or 5 or 30-minute) drive from your dive shop.

Of course, it would be best to study the market around your planned business location before opening your doors! It’s preferable to be located in a part of town where you’ll find a good percentage of people matching the socio-demographic profile of a scuba diver.

But for now, let’s note that people searching for scuba diving lessons usually want a pool or dive site “near where they are.” The question, now, becomes: Can they find it?

How are we helping consumers find a dive training location?

Try doing the exercise yourself. If you are searching online for a place to take a scuba diving course, you will find places where you can buy dive gear. In today’s world, this is absurd.

On the training agencies’ websites and on Google maps, you can find the addresses of local dive shops where you can buy gear. But where is the course taught? Training agencies only list dive centers on their website, which is a location where you can find the six businesses under one roof. They do not list the pool or dive site locations where the course is actually taught.

I’ve seen a ludicrous case in an urban area. On the West-end of town, there was a dive center using a pool in the East-end of the city to teach scuba diving courses. Imagine how many clients living near this dive shop were displeased when realizing they had to drive to the other end of town (about an hour drive) to take their courses. And it was even more frustrating for them after realizing that another dive center, located in mid-town, was teaching in a pool in the West End.

Our question is this: Why aren’t pool class locations listed for people searching for an entry-level scuba diving course?

It is more of a problem in urban areas (origin dive centers) than tourist destinations. In many tourist destinations, there’s a dive center within the resort, with a pool on-site.

Even if you are vacationing on a small island like Key West in the Florida Keys, you will find addresses of dive stores on Duval Street. I could pick any of them. But they are probably teaching in the pool at one of the hotels and leaving for open water dives from the marina. What I would like to know is if there is a dive center teaching in the pool at the hotel where I am staying. Of course, I can call and ask or I can peruse the numerous dive shop websites to try to find the information. But in today’s world, don’t you think clients expect that kind of information to be readily available online (e.g., on Google Maps)?

And it is more than just frustrating clients about the distance to travel to the actual teaching site. We are also missing out on marketing opportunities. For instance, I managed a dive center in an urban area where we were using five different pools all around town to teach entry-level courses. I had to jump through hula-hoops to get these locations listed on Google Maps — but it paid off. A lot! Meanwhile, on the training agency website, the only thing listed was my downtown dive center location where no courses were taught.

Think about it!

Why are we providing addresses where you can buy dive gear when somebody is looking for a place to learn scuba diving? When you search online for driving lessons, do you get the addresses of car dealers?

It doesn’t make sense. And it hurts both customer satisfaction and our marketing potential.

Before we get into the Octopus Strategy solution, let’s look at dive gear.

Second Part of Our Dive Industry Octopus Strategy: Scuba Diving Gear

When people shop for dive equipment, we believe their selection criteria are significantly different than when they shop for a place to learn to dive.

What do consumers expect when shopping for dive gear?

In today’s internet world, people regularly shop online before buying in your physical retail store. And when they buy something, they expect to get it today or tomorrow. Even “tomorrow” is often considered late nowadays. Amazon is pushing hard on same-day delivery. That’s the society we live in. Perhaps it is not socially sound — and too stressful — but it is what it is. We can’t ignore it.

These customers’ expectations and habits have many consequences for our dive business. For instance, it means that consumers expect to have access to all models, in all sizes and all colors, readily available, today or tomorrow. How many dive shops have that kind of inventory in North America? Approximately, zero.

Typically, the dive store stocks what the dive owner enjoys diving with. And the dive instructors are instructed to wear these hand-picked products to promote them. Well, that is not good enough nowadays.

You may be stocking only the black version of the wetsuit in the sizes most in demand (e.g., medium, large, and XL) but the customer knows that it’s also available in purple and size Medium-Large-Tall. You can try to make that client swallow a black wetsuit that doesn’t fit properly, but that would be a very lousy experience and it is not the way to get repeat customers and grow a business. What is more likely to happen is that the client will tell you that he will “think about it,” walk out, and order it online for delivery tomorrow.

So, in brief, to meet today’s consumer expectations, we need a large inventory with all brands, all models, all sizes, all colors — available today or tomorrow. Typical North American dive stores have revenues of about $500K, annually. It’s impossible for a store with such a low annual sale volume to keep that kind of inventory.

But there’s a good thing about scuba gear sales. How far could such a large-inventory store reach?

It is my experience that if you have a well-stocked, reputable store, people will drive a fair distance to come shopping with you. After all, it’s a niche market. There isn’t a dive store at every corner. And consumers don’t buy dive gear every month. Therefore, many scuba divers don’t mind driving farther for dive gear than they do for their entry-level dive course. And this is part of the Octopus Strategy foundation.

How do we currently sell dive gear?

Well, we try to sell it the same way we were before the internet showed up.

Training agencies and dive gear manufacturers are still insisting that the local dive shop must persist as the main link in the chain to reach divers — even if the dive stores have barely anything in stock, do not satisfy today’s consumers’ expectations, and have no quality assurance process. Why are we insisting on using a model that does not suit today’s world?

There are a few eCommerce dive retailers with a good inventory and a well-maintained website, but they are the exception. They are also seen as the black sheep of the dive industry. And they are mostly disconnected from dive courses being taught around the country.

Certainly, nowadays, we can do better — for our profitability and customer satisfaction. And this is where the Octopus Strategy comes in.

How can we satisfy two different sets of criteria for selling dive training and gear?

Selling dive gear requires a setup much different than selling and providing dive courses. The scuba gear store can cover a much wider geographical territory than the dive school. This brings us to the conclusion that these two departments shouldn’t be under the same roof.

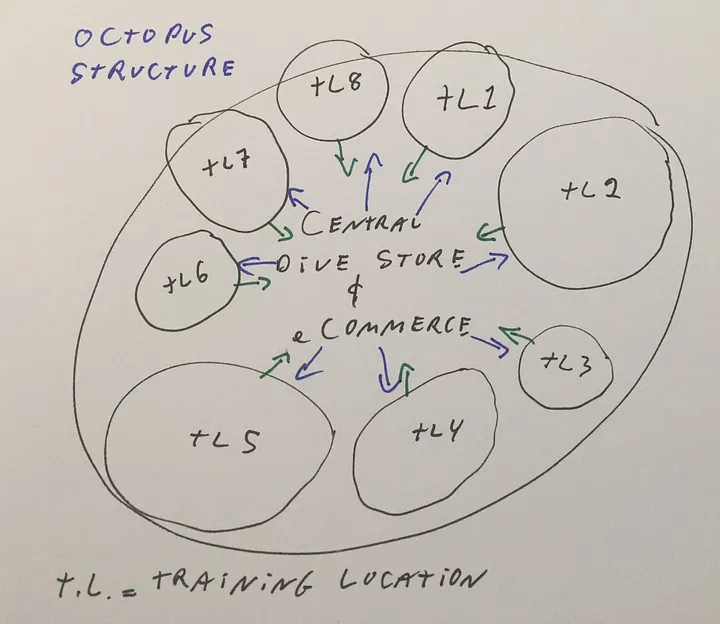

Let’s have a look at what it looks like. Imagine we have various pool locations, each one serving a relatively small area. Then, we have a retail store selling gear to consumers in a much larger area.

Each teaching location feeds clients to the retail store. And the centralized dive store sends customers to the local teaching locations. Such a setup means that instructors who are passionate about teaching and diving can focus on that, without having to improvise on the management of a retail store and eCommerce website. And the larger dive store can afford a professional retail & eCommerce manager. We can have people do what they are good at, and leave the rest to people who are good at the rest.

This is how an Octopus Structure looks like on our whiteboard:

The green arrows represent gear sales sent to the centralized and well-stocked dive store by instructors in numerous teaching sites. The blue arrows represent support provided to these small teaching locations by the centralized one. For instance, the central location could manage the eCommerce website with a booking system for each of the teaching teams.

The Octopus Strategy is an easy concept. But how can we implement it? That’s the big question.

How can we implement the octopus selling & distribution strategy for the scuba diving industry?

For the Octopus Strategy to bring value to consumers, we need training (pool) locations listed online when potential clients search for an entry-level scuba diving course. This would require training agencies to change their website listing policy. We will probably not see this happening until a smaller training agency starts innovating. In the meantime, we can simply ignore them! Google is much more important to a dive center nowadays than the PADI website.

In fact, at the first dive center I owned, most of our new clients came from word of mouth, the Yellow Pages, and the PADI website. However, at the last dive center I managed, we barely got any traffic or referrals from the PADI website – it was pretty much as useless as the Yellow Pages. So, stop giving all your powers to the dive training agency. Do what is good for your clients, not for the private equity billionaires milking PADI.

Of course, we need these teaching locations listed on Google Maps. This is not easy, but it’s do-able. I’ve done it, and it brought us many new clients living near these pool locations.

The Octopus Strategy has a better chance of success with a smaller or new dive training agency ready to innovate.

It leaves us with dive gear. How can we have a profitable retail store stocking all (many) brands, all models, all colors, and all sizes? For this to work, financially, this retail store needs to serve a significantly larger market than typical local dive shops are currently covering. It needs to be the head of an octopus with many arms.

Furthermore, this retail store needs to have a professional eCommerce branch. This will help boost the sales volume to justify a more extensive inventory.

In fact, with the internet nowadays, we could imagine the octopus extending much beyond a geographic region. With UPS, FedEx, and Postal Services, you can provide next-day dive gear to an instructor and his students in Omaha, Nebraska, even if you are located in Miami, Florida.

What about the other services offered by local dive centers?

Beyond selling scuba lessons and dive gear, local dive centers sell dive outings (either local activities or fly-away trips to exotic destinations), rental dive gear, repair & maintenance services, and cylinder fills.

Dive outings go hand in hand with the revised dive training network proposed in the Octopus Strategy. That’s the easy one!

Refilling cylinders is the reason used by many dive professionals to shame scuba divers into supporting their local dive shop. That is a weak marketing strategy. Each one of the 6 businesses operated by a local dive center must be a self-sustainable and profitable business unit. So how do we do it?

Obviously, we need to stop operating our fill stations as lost leaders to bring people into the shop in the hope of selling them some equipment we do not even have in stock. To do that, we need to locate these fill stations where they will provide more value to scuba divers: At the dive site!

The same principle applies to dive gear rental. I do not need to drive downtown to a ski retail store to buy snow and rent a pair of skis before going skiing! It’s never easy to fully satisfy customers, but it is the only way to go.

If we really want to push the creativity envelope, why not discuss if we could find a way to bring people into exploring the underwater world without the traditional scuba diving cylinder? It’s called tankless (surface-supplied air) diving and is the topic of a separate post.

As for repair & maintenance, it could easily go either way. It could be performed locally or at a centralized location.

We’ve further discussed a restructured local dive center in an article titled Redefining The Role of The Dive Center.

What’s Next?

The Octopus Strategy is about enhancing value and convenience to client-divers while improving our internal efficiency. We’ll complete this discussion when looking at a complete redesign of the local dive shop.

Otherwise, we believe the octopus strategy should be part of a larger game plan to draw and implement a Blue Ocean strategy. The company implementing it should include ownership of a training agency (with a substantial revision on how we teach scuba), an in-house gear brand, retail, and eCommerce. This would provide a base on which we could build consistency in the quality of dive experience under a reliable brand.

If you want to invest in such a project, let me know!

Continue reading about Shifting Tides: Scuba Diving Industry Assessment & Strategies for Today’s Scuba Divers.

If you found the information on this page valuable, would you consider buying me a coffee?

Either way, let’s work together on “raising the bar” in the dive industry to satisfy today’s consumers!

Your Dive Industry Compass

Scuba Diving Market Research, Surveys, Reports & Statistics

Shifting Tides

Strategies for Today’s Scuba Divers

Living The Scuba Dream

Plan Your Scuba Instructor Career & Deep Dive the Plan

You may also be interested in The Immersion Zone (our podcast), Scubanomics (our newsletter for dive professionals), and our published books & reference guides.